The Transportation and Climate Initiative (TCI) states have released both a draft MOU and multiple policy scenarios for a regional cap-and-invest program on transportation emissions. The release comes almost exactly a year after they first signed a statement of intent to design the TCI program over the coming year.

This is a quick turnaround, given the complex modeling, extensive public engagement, and challenging inter-state negotiations that had to take place to get here. With draft scenarios released, the states will now undergo intense negotiations and public input over the next few months with the goal of finalizing the policy by Spring of 2020, and implementing it by the start of 2022.

Here is what the draft MOU and modeling results tell us:

Emissions Projections and Cap Trajectory

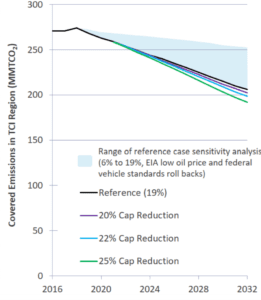

First, before running through policy scenarios, the states need a projection for emissions levels absent a policy. Between 2022 and 2032, transportation emissions are expected to decline by 19% on current pace, due to existing policy on fuel efficiency and increasing electric vehicle (EV) sales.

However, the reference case also underwent “sensitivity analysis”, in which future emissions differ based on uncertainty around oil prices and future federal policies. They find that future emissions from transportation could decline by as little as 6% over the same time period, although any consideration for emissions reducing beyond 19% (such as further electric vehicle innovation, higher oil prices, or strengthened federal policy) are absent from analysis.

In reaction to these policy scenarios, the modeling exercises consider three cap trajectories over the 2022-2032 timeframe – a 20% reduction, 22% reduction, or 25% reduction. While this is a somewhat unsurprising result, this is far short of the 40-45% reduction needed in line with our understanding of the climate emergency.

Price Impacts

States have clearly indicated that a main goal of the program is the revenue it raises for investment into modern, accessible, and low-carbon transportation, more than the price incentive to change behavior, which is why cap trajectories remain modest at this point.

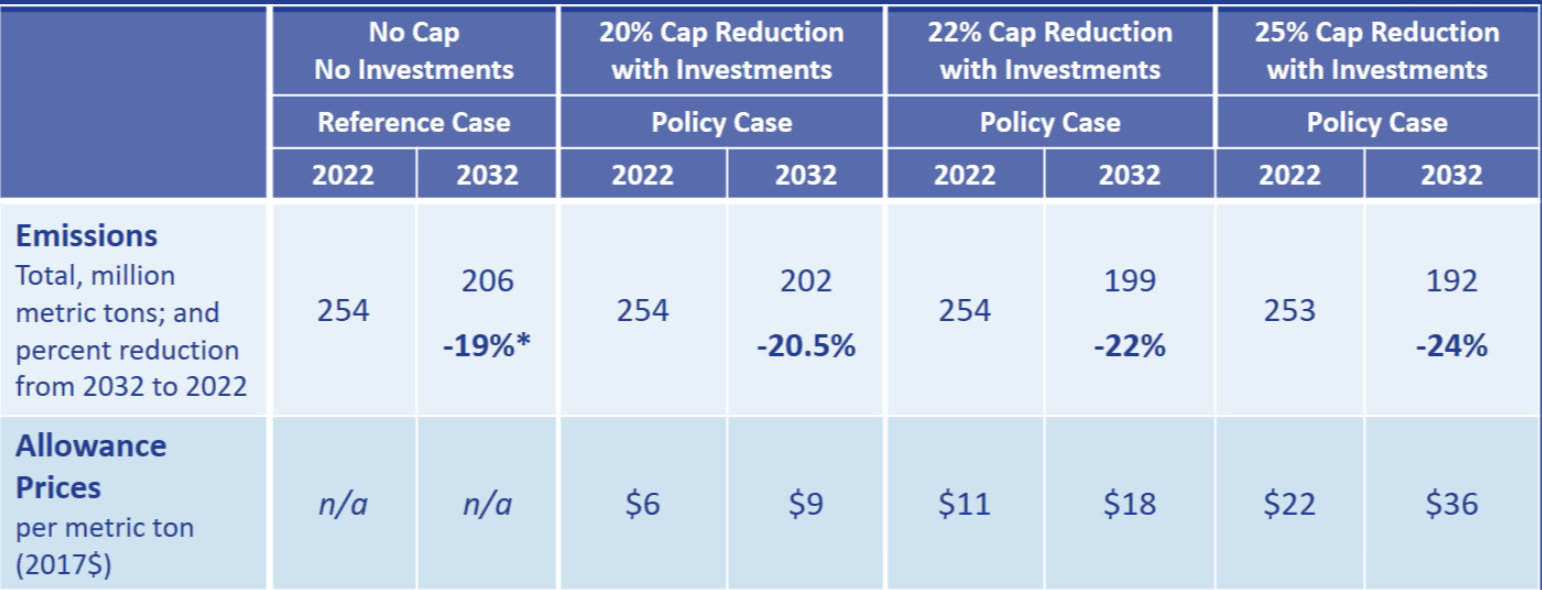

Under the best scenario, modeling indicates that allowances will cost about $22 per ton of carbon dioxide or equivalent in 2022, the first year of the program.

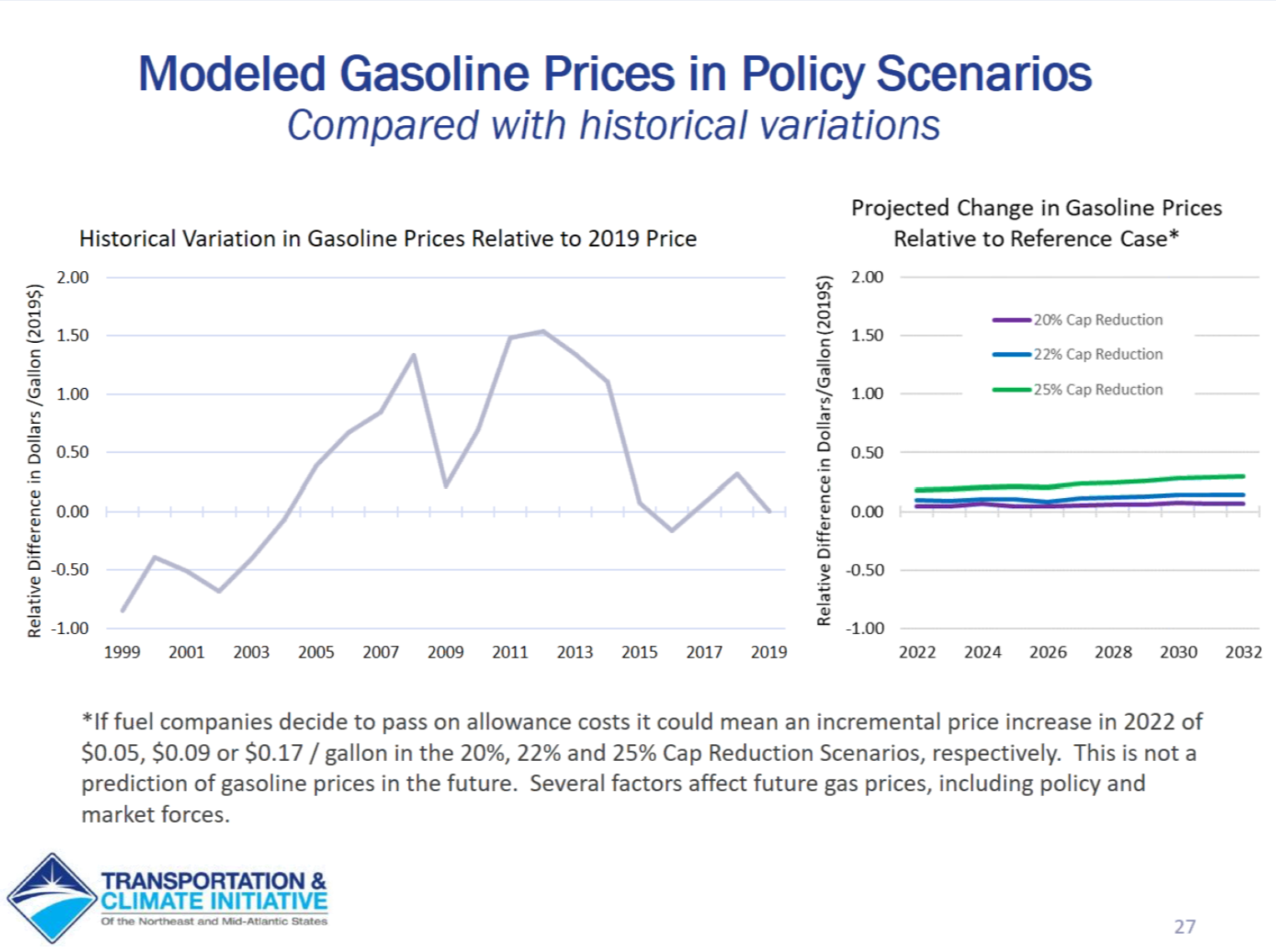

This amounts to a 5-17 cents/gallon increase in gas prices in the first year of the program, which is minuscule compared to how prices have historically fluctuated in the region.

Revenue

Modeling indicates that the program could raise up to $68 billion to invest into clean modern transportation in the TCI region in 10 years. The more ambitious the cap, the higher allowance prices are expected to go, which leads to greater revenue.

Potential Revenue from TCI

| State | 10-year revenue |

| Connecticut | $3 billion |

| Delaware | $900 million |

| District of Columbia | $230 million |

| Maine* | $1.8 billion |

| Maryland | $5.5 billion |

| Massachusetts | $6.3 billion |

| New Hampshire* | $1.3 billion |

| New Jersey | $11.5 billion |

| New York* | $14.9 billion |

| Pennsylvania | $12 billion |

| Rhode Island | $765 million |

| Vermont | $666 million |

| Virginia | $9.3 billion |

| TCI Region | $68 billion |

*Gov. Sununu pulled New Hampshire from the TCI process on December 17th. New York and Maine are still in “observer status” for the TCI process, meaning they are involved but not actively participating in the design process.

Source: Georgetown Climate Center and author’s calculations.

Given the relatively low ambition of the cap trajectory and allowance prices projected, it will be crucial to direct the revenue from TCI towards clean, modern transportation projects that lower pollution in the region, improve public health, and achieve other key goals of the states. In this way, investment revenue can be used as a multiplier of emissions reductions and climate solutions, while keeping frontline and disproportionately burdened communities at the forefront of those investment benefits.

Program Benefits

The program went through extensive modeling exercises to see what benefits the region will realize from such a cap-and-invest program, and the results are promising. Virtually every measure of economic and social well-being improves from this program over the reference case, including:

- Up to $10 billion in public health benefits, including 1,000 fewer premature deaths, 1,300 fewer asthma attacks, and 1,700 fewer traffic injuries.

- Net cost savings of $4.9 billion for consumers through reduced reliance on gasoline and diesel to get around.

- $5.6 billion increase in regional GDP and up to 25,000 new jobs created, largely due to decreased reliance on imported gasoline and increased spending on the local economy.

How Should We Be Thinking About This?

The program is diligently designed and thoroughly modeled, but it still lacks ambition currently. As expected, TCI is following a similar progression as the Regional Greenhouse Gas Initiative (RGGI), where the outset of the program is designed to be overly conservative in order to avoid any political or economic risk. Then, the program can be adjusted downward in future years to claim credit for emissions reductions that were primarily driven by other factors.

We have decades of experience with carbon pricing programs and know that there is massive economic and environmental benefit to capping emissions, raising revenue, and investing that revenue into the modern transportation solutions that the region desperately needs. The billions in economic and public health benefits found by modeling exercises come as no surprise.

Nothing is technically or legally keeping the region from putting together a more ambitious proposal. Greater ambition equals better benefits for all of us. Rather, what determines the details of this program will be the political dynamics of each state and their negotiations with each other. This stage of modeling indicates that a 25% cap trajectory is as far as the governors are willing to go at this time.

If this holds true in the finalized policy, then other design aspects of the program, such as the price floor, future cap adjustment processes, and revenue spending priorities, will be key priorities to get right. What will ensue is a vigorous deliberation process between the TCI states and the public to hash out how far this program is willing to go.

The TCI states have set a goal of completing a final policy design and MOU by Spring of 2020.