by TIM CRONIN, July 3rd 2018

Quick Facts

- A new state law establishes a permanent sales-tax holiday, raises the minimum wage to $15/hour, and mandates paid-leave.

- Most provisions don’t go into effect until 2023.

- The compromise law was passed after last-ditch negotiations on Beacon Hill.

Last week, Governor Baker’s signed the so-called ‘Grand Bargain’ bill into law (H.4640). This sweeping compromise increases the state’s minimum wage, establishes a permanent sales tax holiday, institutes a new paid leave program in Massachusetts and eliminates time and a half requirements on Sundays and holidays.

With over 80% of CABA member businesses having under 50 employees, we wanted to provide you with the information you need to start planning for the long-term payroll and human resources costs associated with the new law.

Below is an outline of the main components of the bargain, the implementation timeline, and how it could affect your small business.

Sales Taxes

Institutes an Annual Sales Tax Weekend: The bill requires an annual sales tax holiday weekend in August. Consumers will be able to purchase most items without paying Massachusetts’ 6.25% states sales tax. This will begin in August of 2019, with the particular weekend will be determined by the Legislature.

Wages

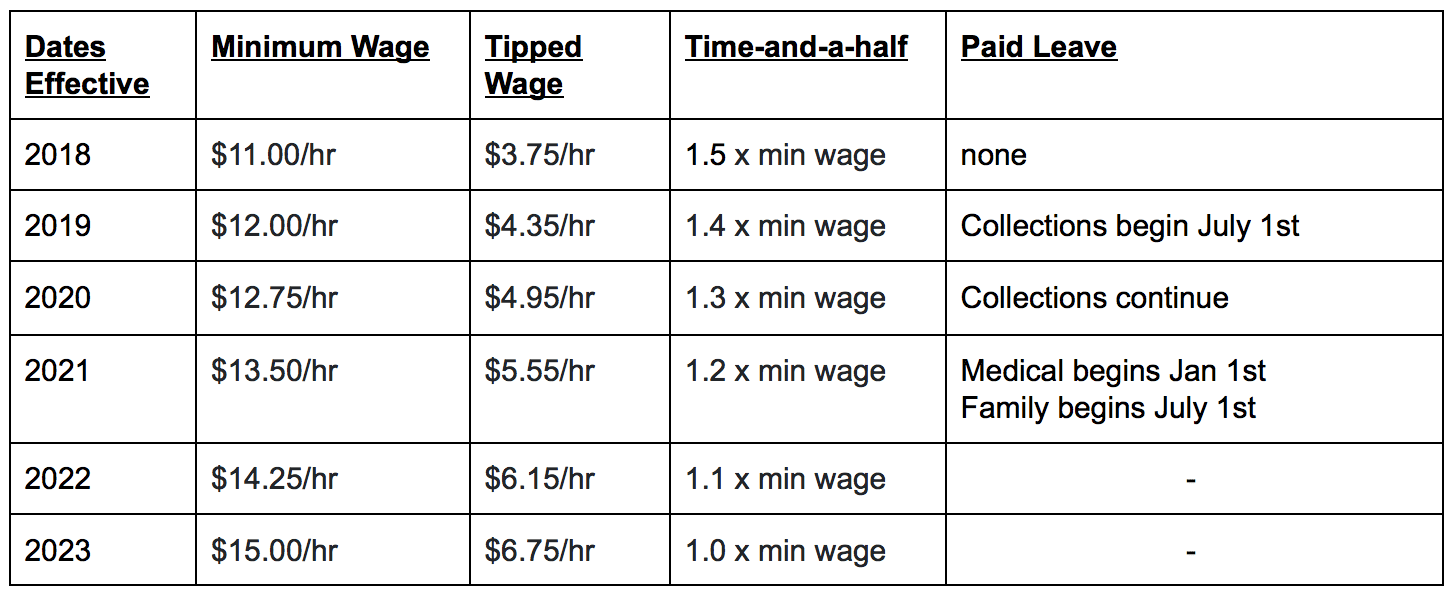

Hourly Minimum Wage Increases: Hourly wages will increase progressively over the next five years from $11 to $15 per hour by 2023. The first increase will take effect in January 2019. It is estimated that a quarter of the state’s workforce will benefit from this pay raise or approximately 840,000 employees.

Wage Increases for Tipped Employees: The minimum wage for tipped employees will increase from $3.75 to $6.75 per hour by 2023. This will affect servers, bartenders, and others who use this “sub-minimum wage.”

Eliminates Time-and-a-Half Pay on Holidays & Sundays: The new law overrides a previous one requiring retailers to pay workers time-and-a-half on Sundays and holidays. This will occur progressively over a five-year period and be put into full effect by 2023.

Paid Leave

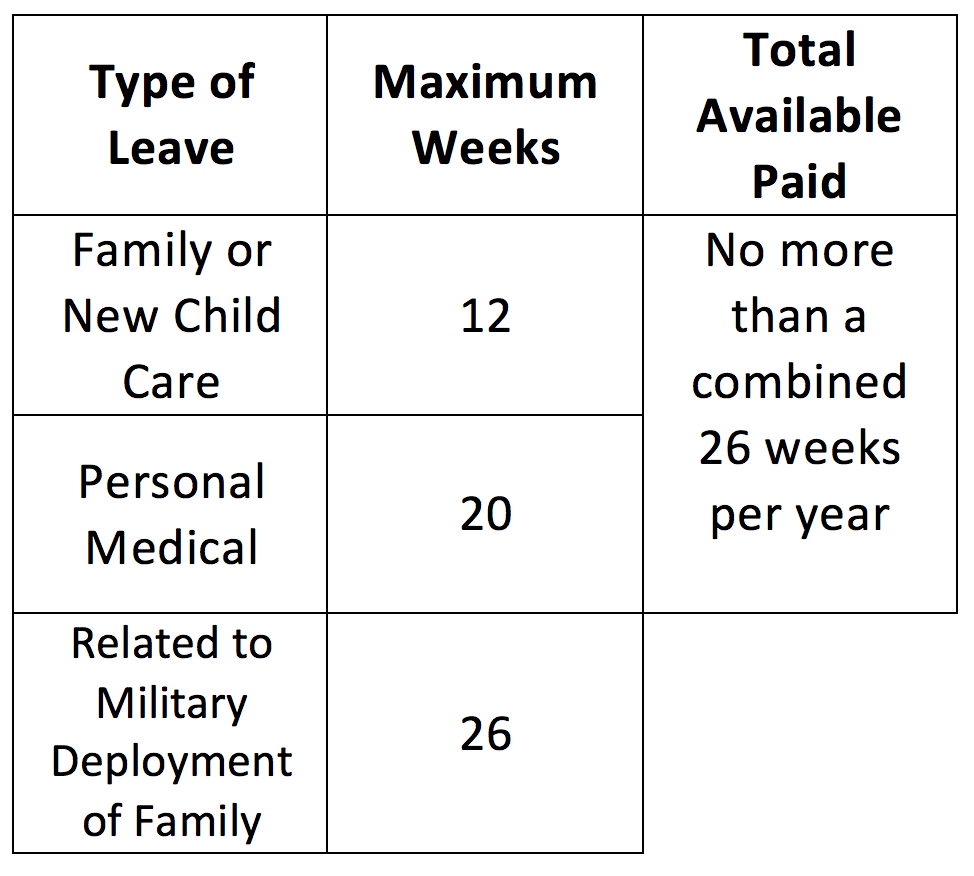

Starting in 2021, Massachusetts employees will be eligible for a new state program which provides a variety of paid leave options. For all paid leave options employees can ensure they will be able to return to their previous job, with the same pay and benefits.

Funding for the program: Funding comes from a new state payroll tax of 0.63% which will be split between employers and employees. Employers with programs that offer a benefit greater than or equal to what an employee receives under the state program have the ability to opt-out of the new law. The Boston Globe estimates the new deduction will amount to between $4 and $4.50 weekly per employee.

Employees will be required to cover 100% of the contributions for family leave and 40% of the contributions for personal medical leave. Employers with 25 or more employees will be responsible for paying the remaining 60% of the contributions for personal medical leave. While employers with 25 or fewer employees will not have to cover the employer portion of contributions, they will still be required to deduct the payroll tax from employees’ wages.

Benefits Paid Out: Benefits would be paid to employees through the new state Family and Employment Security Trust Fund.

If someone is earning less than 50 percent of the average state wage (currently $1,338.05 per week), they would be paid 80 percent of their salary during their leave. If they are earning more than that, they would be paid 50 percent of their salary. The maximum pay would be capped at $850 a week initially, a figure that will be annually adjusted to remain at 64% of the state average weekly wage.

Other Considerations: Self-employed persons may opt into the program, but must cover 100% of the contributions. The payroll tax is set to take effect July 1, 2019

State officials are expected to publish a comprehensive guide for complying with the law in the coming months.

Political Context

Lawmakers had been considering a ‘Grand Bargain’ for the last few months, with the intention of keeping multiple proposed ballot questions off the November ballot. One of the most significant ones being a ballot question to lower the state’s sales tax from 6.25 to 5 percent. Another two, pushed by Raise Up Massachusetts, sought to raise the minimum wage to $15/hour and institute paid leave. These three initiatives were all expected to receive overwhelming support by Massachusetts voters in November, despite their potential budget implications.

What finally moved legislative leaders to strike a deal, was a decision by the Supreme Judicial Court that a proposed constitutional amendment raising taxes on income over $1 million (“millionaires tax”) could not go forward. Lawmakers were looking to this 4% tax on the state’s highest income earners to offset the anticipated $1.2 billion hit to state revenues from cutting the sales tax. Following the court’s decision, negotiators from all sides entered into frantic negotiations to come up with a bargain, finally agreeing to a framework on June 21st.

TIM CRONIN Policy Associate

TIM CRONIN Policy Associate