Author

Greg Casto ǀ Senior Communications Associate

Editors

Jonah Kurman-Faber ǀ Policy & Research Director

Ruby Wincele ǀ Policy & Research Manager

Amanda Pontillo ǀ Communications Director & Operations Lead

Climate XChange’s Dashboard Digest is a deep dive on each of the policies that we track in the State Climate Policy Dashboard and an exploration of how these policies can interact with one another to form a robust policy landscape. The series is intended to serve as a resource to state policy actors who are seeking to increase their understanding of climate policies, learn from experts in each policy area, and view examples of states that have passed model policies.

Inflation, supply shortages, and rising demand for energy have caused monthly residential electricity costs to increase five percent from 2021 to 2022 alone. Climate change will continue exacerbating energy demands, with increasingly extreme weather amplifying heating and cooling needs. The growing issue of high energy costs demands solutions. Improving a building’s energy efficiency is one of the best (and cheapest) ways for owners to reduce their energy costs and carbon footprint. The problem is while energy efficiency improvements can result in long-term energy savings, these projects, especially for large buildings, can have major upfront investments with long timelines for recouping initial costs.

Fortunately, this challenge isn’t new. Back in 2007, the city of Berkeley, CA took a concept long used to fund public benefit projects like sewers and streetlights and applied it to residential clean energy projects. The idea was simple: building owners could access financing for clean energy projects and pay the loan back over a long period of time through an assessment charge on their property tax bill. Berkeley’s program was well received, and soon after others appeared in towns across the country, followed by programs at the state level. These programs were called Property Assessed Clean Energy (PACE). Eventually, the Obama administration announced the program would play a key role in their climate strategy, building even more momentum for the policy.

Energy efficiency financing programs like PACE help building owners access the necessary capital to make immediate efficiency improvements while continuing to see benefits long into the future. Existing building stock will continue to be around for a long time, and it’s vital that as technology improves, older buildings keep up with new energy standards. These financing policies help projects get off the ground when they otherwise might not.

In this article for the Dashboard Digest, we’ll explore two of the most popular state-driven mechanisms for efficiency financing — PACE and Energy Savings Performance Contracts (ESPCs) — their benefits and barriers, and how states can reduce building sector emissions through financing policies.

Learn more about other Buildings & Efficiency policies on our Dashboard Resource Hub.

READ MORE >

What is Energy Efficiency Financing?

Energy efficiency projects are not only a critical way to reduce carbon emissions, they also make economic sense. Over time, energy bill savings from efficiency upgrades pay for the project’s cost and continue to accrue in the future. For simple energy efficiency projects on smaller buildings, owners may choose to pay for upgrades all at once. But for larger buildings, like universities, hospitals, and businesses, building owners may not have sufficient capital to afford the entire project. Energy efficiency financing works a lot like any other loan — it allows the building owner to access necessary funding while paying it back over time — with some advantages to more traditional lending options.

There are two popular state-driven financing mechanisms: PACE loans and ESPC programs. Both fund energy efficiency projects, but each has different advantages and drawbacks and targets different markets in the buildings sector. PACE loans are available to privately owned properties in commercial and residential sectors, while ESPC programs are more commonly used by state and locally owned properties.

Property Assessed Clean Energy (PACE) Loans

PACE loans are an effective way for building owners to finance various types of clean energy projects, from efficiency (lighting, weatherization, and infrastructure improvements) to renewable energy (solar, microgrids, and EV charging) and resiliency (earthquake and hurricane protection, and stormwater management improvements). Generally, PACE programs must be enabled at the state level and authorized and administered by local governments.

PACE programs are also subdivided into two types: Commercial PACE (C-PACE) and Residential PACE (R-PACE). C-PACE programs are much more widely available than residential ones, and in 2020, the Department of Energy reported that cumulative C-PACE financing dollars have been growing rapidly since 2010.

Building owners that want to secure a PACE loan first contact their local PACE program, which will connect the owner with a contractor who completes a comprehensive energy audit. This audit determines where energy efficiency improvements can be made and what the cost will be. The PACE program helps secure up to 100 percent of the financing for the project for the building owner who can pay it back over a long period of time, sometimes up to 30 years, as an additional payment on their property tax bill. This is an important distinction between PACE loans and other financing options: the loan is tied to the property, not the borrower. This means that even if the building changes ownership, the PACE loan is carried with it.

Residential PACE (R-PACE)

In the beginning, PACE programs were available for commercial and residential building owners who wanted to improve energy efficiency. Both types of PACE programs have faced challenges, but R-PACE has largely stalled out in the past decade — it’s currently only available in three states (California, Florida, and Missouri). In 2010, the Federal Housing Finance Agency, the regulatory agency that makes it possible for mortgage lenders to have money to lend, ordered the government’s mortgage underwriters to stop purchasing mortgages with PACE loans attached to them due to a lack of consumer protections. This essentially stopped most state-level R-PACE programs in their tracks. Advocates say that additional consumer protections make R-PACE programs at the state level worth exploring. To date, R-PACE programs have financed upgrades on over 340,000 homes and abated around 9.5 million metric tons of CO2e (about the same amount of total residential emissions from the entire state of Minnesota in 2021).

Learn more about hazards with R-PACE loans.

READ MORE >

Energy Savings Performance Contracts (ESCPs)

While PACE loans can allow building owners to access necessary capital for efficiency projects, this loan type is not always the right choice for all building owners. ESPCs have emerged as an alternative financing mechanism for certain types of buildings, typically larger groups of buildings in what’s known as the MUSH market (municipalities, universities, schools, and hospitals). The main difference between the two programs is that ESPCs offer guaranteed energy performance savings to the building owner, which are then used to repay the capital over time.

Building owners can enter into one of these contracts with a third party, an Energy Services Company (ESCO), which will conduct an energy audit to assess the project’s cost and projected energy savings. The ESCO may or may not help the building owner access funding, but they guarantee the amount of energy savings over time. The building owner then uses those savings to pay back the lender for the cost of the upgrades. The ESPC protects the interest of the building owner, because if actual energy savings fall short, the ESCO is responsible for paying the difference.

Learn more about ESPCs with this Department of Energy toolkit:

READ MORE >

Availability of PACE & ESPC Programs

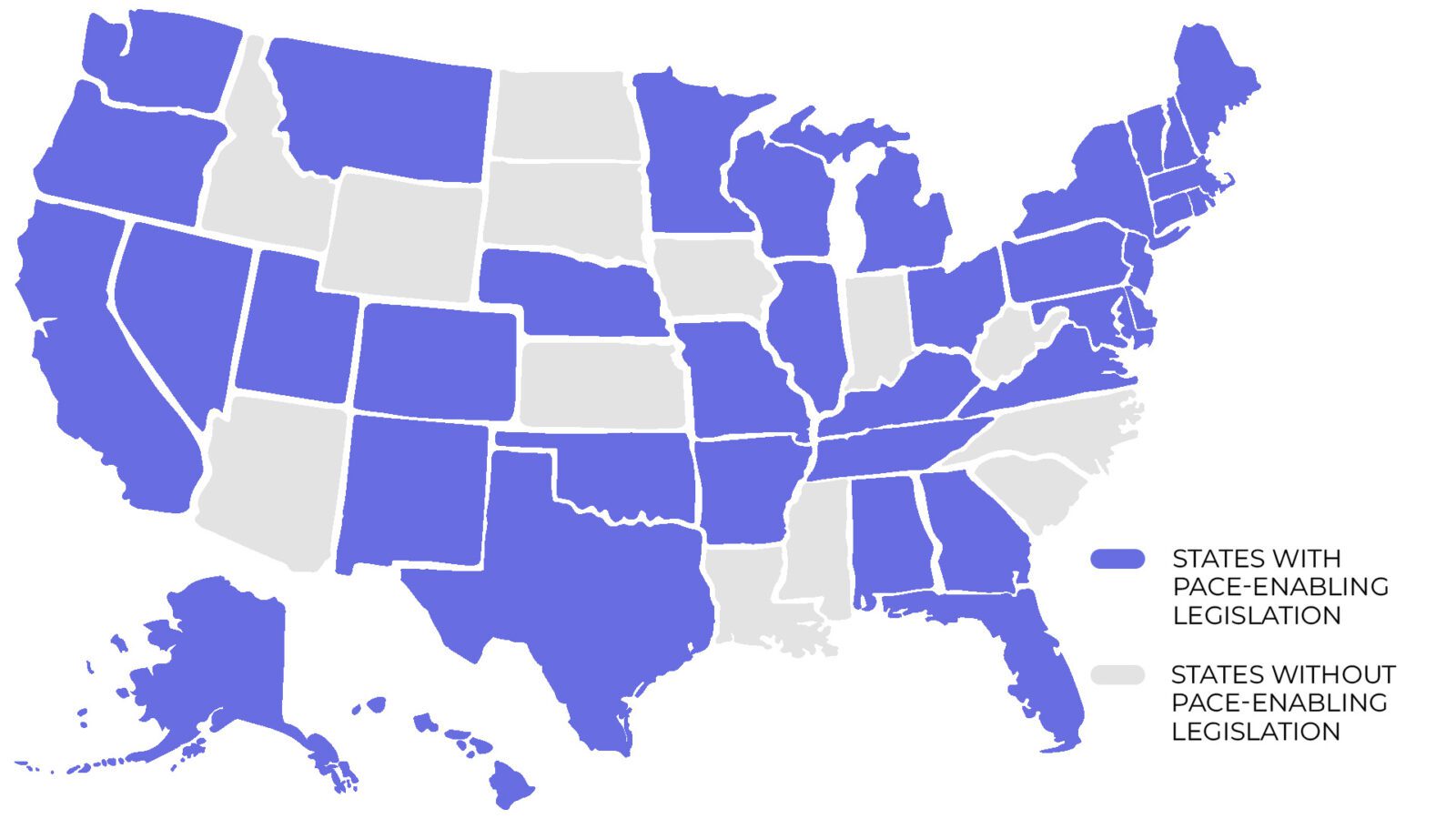

C-PACE programs are available in 38 states across the country. Currently, R-PACE is only available in California, Florida, and Missouri.

ESPCs are enabled in all 50 states.

Benefits of PACE & ESPCs

Improved energy efficiency in buildings can result in reduced emissions, lower energy bills, and improved public health, all while increasing property value. New construction across the country is increasingly subject to more stringent energy requirements, but it’s difficult for these laws to address the existing building stock in the state. Since buildings last for quite a long time, it’s vital that states pass policies that make existing ones as efficient as possible. Efficiency financing policies like PACE and ESPCs offer avenues for building owners to access the necessary capital to complete energy efficiency projects.

PACE Program Benefits

- 100 percent financing — PACE programs offer building owners loans up to 100 percent of the financing for energy efficiency projects. The building owner works with the PACE program to find a contractor and access capital with no upfront cost.

- Positive cash flow — Since PACE loans can be paid back over long periods of time, sometimes up to 30 years, the energy savings from efficiency improvements can make projects’ cash flow positive from day one. This can help make repayment more affordable for building owners.

- Loan tied to property — This can be beneficial to businesses that want to make energy efficiency improvements but may not want to take on the liability of a loan for a property that they own temporarily. This can make it more challenging for the owner to sell the building because the loan will transfer, but it can help the decision to make the improvements in the first place.

- Helps renters — While renters cannot apply for PACE loans (because they don’t own the property), the program can align the interests of renters and building owners by sharing both the benefits of energy savings and the cost of the assessment on the property tax bill.

ESPC Program Benefits

- Guaranteed energy savings — Under an ESPC, the building owner and ESCO agree to an amount of guaranteed energy savings from project improvements. This is assessed by the ESCO before the project and monitored through a Measurement & Verification (M&V) process to ensure that the guaranteed savings are met. Even in the case where the savings fall short, the ESCO is responsible for making up the difference.

- Target large groups of buildings — Large groups of buildings, like universities and municipalities, are often great customers for ESPCs because they can finance multiple types of projects, from energy savings to water conservation and infrastructure improvements all under the same contract.

Barriers to PACE & ESPCs

- Only available to property owners — Tenants can benefit from energy financing programs, but only when building owners choose to participate. Like many energy efficiency policies, PACE loans and ESPCs are only available to property owners, leaving tenants with little power to improve their overall energy efficiency and reduce energy bills.

- Lack of sufficient consumer protection — PACE programs, particularly R-PACE, lack many of the federal protections that other lending programs do. Even in states where R-PACE programs exist, building owners are potentially at risk of being taken advantage of by predatory lenders. The Consumer Financial Protection Bureau (CFPB) proposed a rule in May 2023 asking Congress to establish additional protections for R-PACE loans, including requiring lenders to assess the ability of the borrower to repay the loan.

- Generally only apply to commercial buildings — With the exception of R-PACE programs in three states, energy efficiency financing programs apply mostly to commercial buildings like businesses, schools, hospitals, and government buildings. This means that residential building owners are often required to seek efficiency financing elsewhere, where repayment options may not be as favorable.

What Can States Do?

Pass enabling legislation

While efficiency financing programs are often administered at the local level, they require legal authority from the state through legislation or executive orders. Currently, 38 states have passed legislation to enable C-PACE programs, and three states have enabled R-Pace, so there are still opportunities for other states.

Provide technical assistance

State agencies can provide educational assistance to building owners who are interested in pursuing PACE loans or ESPC projects. This can help increase access to efficiency financing and help protect building owners from potentially predatory lending. It’s essential that building owners understand how PACE loans and ESPCs work so that they can enter into these agreements with the full knowledge of any risks involved.

Establish consumer protections

The federal government lacks sufficient consumer protections for PACE loans, particularly R-PACE, so states interested in these programs must ensure that procedures are in place to protect borrowers.